The cost of new fixed-rate mortgages is continuing to rise, so the largest mortgage lender in the UK will increase rates on Wednesday.

A variety of loans for new borrowers will see interest rates raised to well over 5% by The Halifax, a division of Lloyds Banking Group.

It comes after a number of large suppliers changed the prices of their products, which caused the average two-year fixed rate deal to increase to 6%.

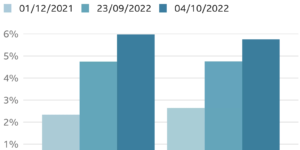

The rate was 5.43% four days ago and was only 2.34% in the beginning of December.

Brokers claim that lenders are “playing it safe” with rates due to the current state of the economy, but prices may soon start to decline.

As traders anticipated a much more significant rise in interest rates by the Bank of England than previously anticipated, the fallout from the mini-budget initially caused a decline in the value of the pound.

Mortgage companies quickly pulled hundreds of deals off the market as a result of that. The availability of goods has begun to increase again this week.

Mortgages are increasingly more expensive, nevertheless. This has an impact on first-time home buyers and 100,000 homeowners who remortgage each month.

Since the mini-budget, the interest rate on a new, typical two-year fixed agreement has been steadily rising.

It was 4.74% the morning of the speech. It is 5.97% right now. Over the same time period, a five-year fixed agreement typically increased from 4.75% to 5.75%.

The largest lenders have recently adjusted their charges.

The largest of them, the Halifax, will raise its own on Wednesday. Apparently, this was done to “reflect the steady increase in mortgage market pricing over recent weeks,” according to a spokeswoman.

It means that its rate has increased from 4.61% to 5.84% for a two-year fixed agreement for a consumer putting down a 25% deposit.

That would result in a monthly payment of £1,179 rather than £1,026 on a 30-year mortgage for someone borrowing £200,000.