A planned £12bn rise in National Insurance from April is “the right plan” and “must go ahead”, Boris Johnson and Rishi Sunak have said, according to the BBC.

In an article in the Sunday Times, the PM and chancellor said the rise – which applies to employees and employers – will help clear the NHS backlog.

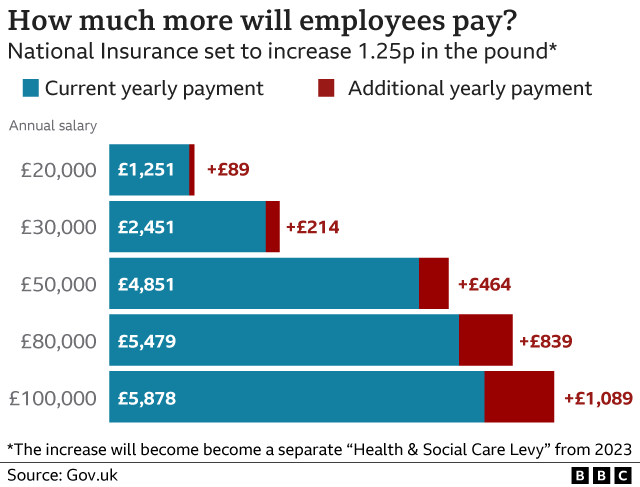

Despite opposition, including from some Tory MPs, they say it is “progressive” because higher earners pay more. With inflation rising sharply, there had been calls to scrap the tax rise.

Under the plans, employees, employers and the self-employed will all pay 1.25p more in the pound for National Insurance from April 2022 for a year. After that, the extra tax will be collected as a new Health and Social Care Levy.

The changes to National Insurance will see an employee on £20,000 a year pay an extra £89 in tax. Someone on £50,000 will pay £464 more.

From April, people earning under £9,880 a year, or £823 a month, will not have to pay National Insurance and will not have to pay the new levy.

Critics have said the increase will have a higher impact on the lower-paid and could contribute to inflation when household budgets are under pressure from rising energy prices and food bills. And business leaders have warned that firms could offset the tax rise by raising prices.

Inflation – the rate at which prices are rising – is already at a 30-year high, reaching 5.4% this month.

Robert Halfon, chairman of the Commons Education Select Committee, was among the Conservative MPs to call for the government to reconsider the move last week.

Senior backbench Tory MPs Robert Jenrick and Mel Stride have called for the increase to be delayed, with Mr Jenrick saying that 2022 would already be “exceptionally hard” for families.

Labour leader Sir Keir Starmer said the increase was the “wrong thing to do”, coming at a time when inflation is at its highest level in 30 years.

The government has said the changes, announced at last year’s Budget, are expected to raise £12bn a year, which will go initially towards easing pressure on the NHS.

A proportion will then be moved into social care system over the next three years as the Covid backlog subsides.

Despite confirming the tax rise, Mr Johnson and Mr Sunak described themselves in the Sunday Times as “tax-cutting Conservatives” and “Thatcherites”.

They added: “We believe passionately that people are the best judges of how to spend their own money.

“We want to get through this Covid-driven phase, and get on with our agenda, of taking advantage of our new post-Brexit freedoms to turn the UK into the enterprise centre of Europe and the world.

“We want lighter, better, simpler regulation, especially in those new technologies in which the UK excels. We are also Thatcherites, in the sense that we believe in sound money.

“There is no magic money tree.”

The article will be seen as a show of unity between the pair, after widespread criticism of Mr Johnson over claims of parties in Downing Street during lockdown.

Mr Sunak is a leading candidate to replace Mr Johnson if a leadership contest is triggered before the next election.

Meanwhile, the government confirmed on Friday that the earnings threshold at which graduates in England start repaying student loans would be frozen in April.

The freeze, which would see a graduate earning £30,000 repay £113 more a year than expected, has been described as a “stealth” tax rise for those affected.

Image Source: Getty Images