In a ‘blunt message,” the Bank of England governor warns interest rates may have to rise even higher

The governor of the Bank of England has defended its decision to raise interest rates, saying there is a “real risk” of soaring prices becoming “embedded”, according to the BBC.

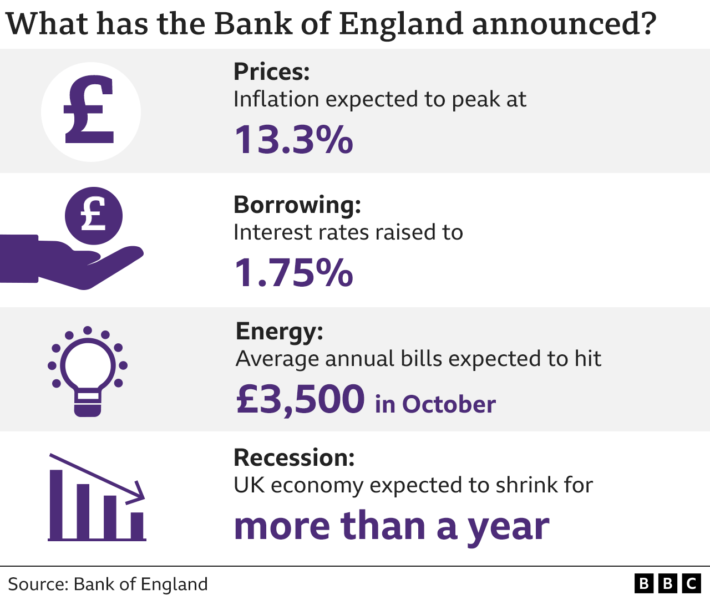

Interest rates rose to 1.75% – the biggest rise in 27 years – with inflation now set to hit more than 13%.

The UK is forecast to fall into recession this year, with the longest downturn since 2008 predicted.

Increasing interest rates is one way to try and control inflation as it raises borrowing costs.

This should encourage people to borrow and spend less. It can also encourage people to save more.

However, many households will be squeezed further following the interest rate rise, including some mortgage-holders.

The Bank’s governor, Andrew Bailey, told BBC Radio 4’s Today programme: “The real risk we’re responding to is that inflation becomes embedded and it doesn’t come down in the way that we would otherwise expect.”

“We’ve had a domestic shock, we’ve had a shrinkage in the labour force over the last two years or so,” he said.

“The first thing that businesses want to talk to me about is the problems they’re having hiring people… They’re also saying to us, actually, they’re not finding it difficult to raise prices at the moment. Now we think that can’t go on.”

He also warned against high pay rises, saying this would make inflation worse and “it’s the people who are least well off who are worse affected because they don’t have the bargaining power”.

However, Attorney General Suella Braverman said interest rates “should have been raised a long time ago”.

In response, Mr Bailey said: “If you go back two years… given the situation we were facing at that point in the context of Covid, in the context of the labour market, the idea that at that point we would have tightened monetary policy, you know I don’t remember there were many people saying that.”

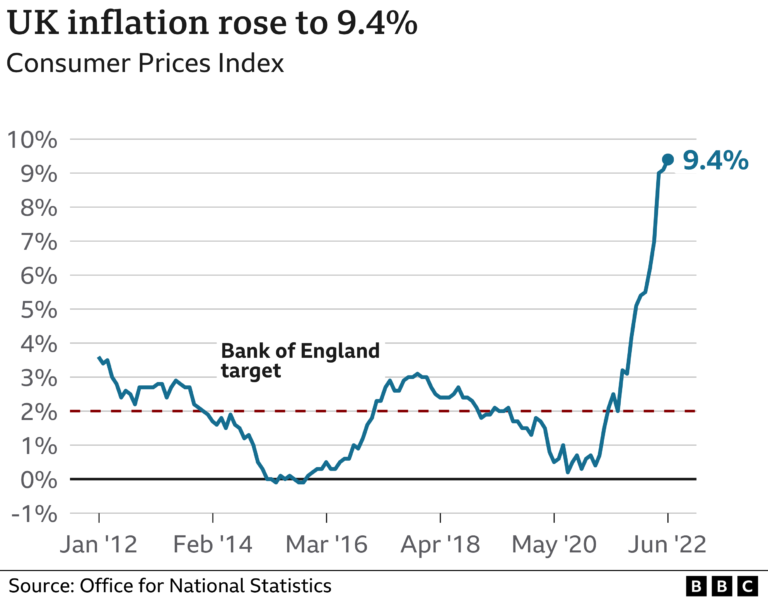

UK inflation – the rate at which prices rise – is currently at 9.4%, which is the highest level for more than 40 years.

But the Bank has warned it could peak at more than 13% and stay at “very elevated levels” throughout much of next year, before eventually returning to the Bank’s 2% target in 2024.

The main reason for high inflation and low growth is soaring energy bills, driven by Russia’s invasion of Ukraine.

Households have also been hit by higher petrol, diesel and food costs.

Real post-tax household incomes – after taking into account inflation – are forecast to fall this year and next year.

Andrew Sentance, who was a member of the Bank’s rates-setting committee during the 2008 financial crisis, told BBC Breakfast: “We’re going to see a couple of years… when household incomes in real terms are squeezed much more severely than we’ve seen in other times since the Second World War.”

The economy is forecast to shrink in the final three months of this year and keep shrinking until the end of 2023.

The expected recession would be the longest downturn since 2008, when the UK banking system faced collapse, bringing lending to a halt.

The slump is not set to be as deep as 14 years ago but may last just as long.

Paul Johnson, director of the independent Institute for Fiscal Studies, said the economic situation would mean there would have to be “many more billions to support households” and more money for public services.

He told the BBC that the Tory leadership candidates, Liz Truss and Rishi Sunak, should be focused on tackling inflation rather than tax cuts.

Mr Johnson rejected the idea tax cuts could be funded in part by “fiscal headroom”.

“What the leadership candidates are talking about is that the Office for Budget Responsibility in March said we’d be borrowing about £30bn less than we absolutely could to meet the fiscal target of a balanced current budget in a few years’ time,” he said.

But he added that this was “highly uncertain” and now “massively out of date”, given the economy was heading for a recession.

Tax cuts

The worsening state of the UK economy dominated a Sky News TV debate between the two conservative leadership candidates on Thursday.

Former Chancellor Mr Sunak, who has trailed Ms Truss in recent polls, has repeatedly said he would prioritise bringing inflation down before cutting taxes if he became prime minister.

Meanwhile, Ms Truss has pledged a package of tax cuts worth £30bn soon after she enters office, which Mr Sunak has argued would increase inflation and the cost of borrowing.

But Ms Truss said cutting taxes would stimulate economic growth and prevent a recession.

Ms Truss, who has been critical of the Bank, has suggested she is considering taking more control over it if she becomes prime minister.

Mr Bailey said the Bank’s independence was “critically important” and he did not think there was a “large desire” in the country to question this.

However, he added he was happy to discuss the issue with the new government.

Labour’s Jonathan Ashworth said the cost of living support measures announced by the government so far was “clearly not enough”.

“There will be families and pensioners across the country waking up this morning, reading the news, who are absolutely terrified because a juggernaut is heading they are way which will smash through family finances,” the shadow work and pensions secretary told the BBC.